Creating and Backtesting Trading Strategies

A step-by-step guide on how to develop, implement, and backtest your own trading strategies using TradingView's Pine Script.

Introduction to Pine Script

Pine Script is TradingView's proprietaryprietary specializedgramming language designed for creating custom indicators and trading strategies. It's powerful yet accessible, making it an ideal tool for both beginners and experienced traders.

Developing Your Strategy

When creating a trading strategy, consider the following steps:

- Define your trading idea clearly

- Identify the indicators or signals you'll use

- Determine entry and exit conditions

- Set risk management parameters

Implementing in Pine Script

Here's a basic structure for a Pine Script strategy:

//@version=5

strategy("My Strategy", overlay=true)

// Define inputs

length = input(14)

// Calculate indicators

sma = ta.sma(close, length)

// Define entry and exit conditions

longCondition = ta.crossover(close, sma)

shortCondition = ta.crossunder(close, sma)

// Execute trades

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

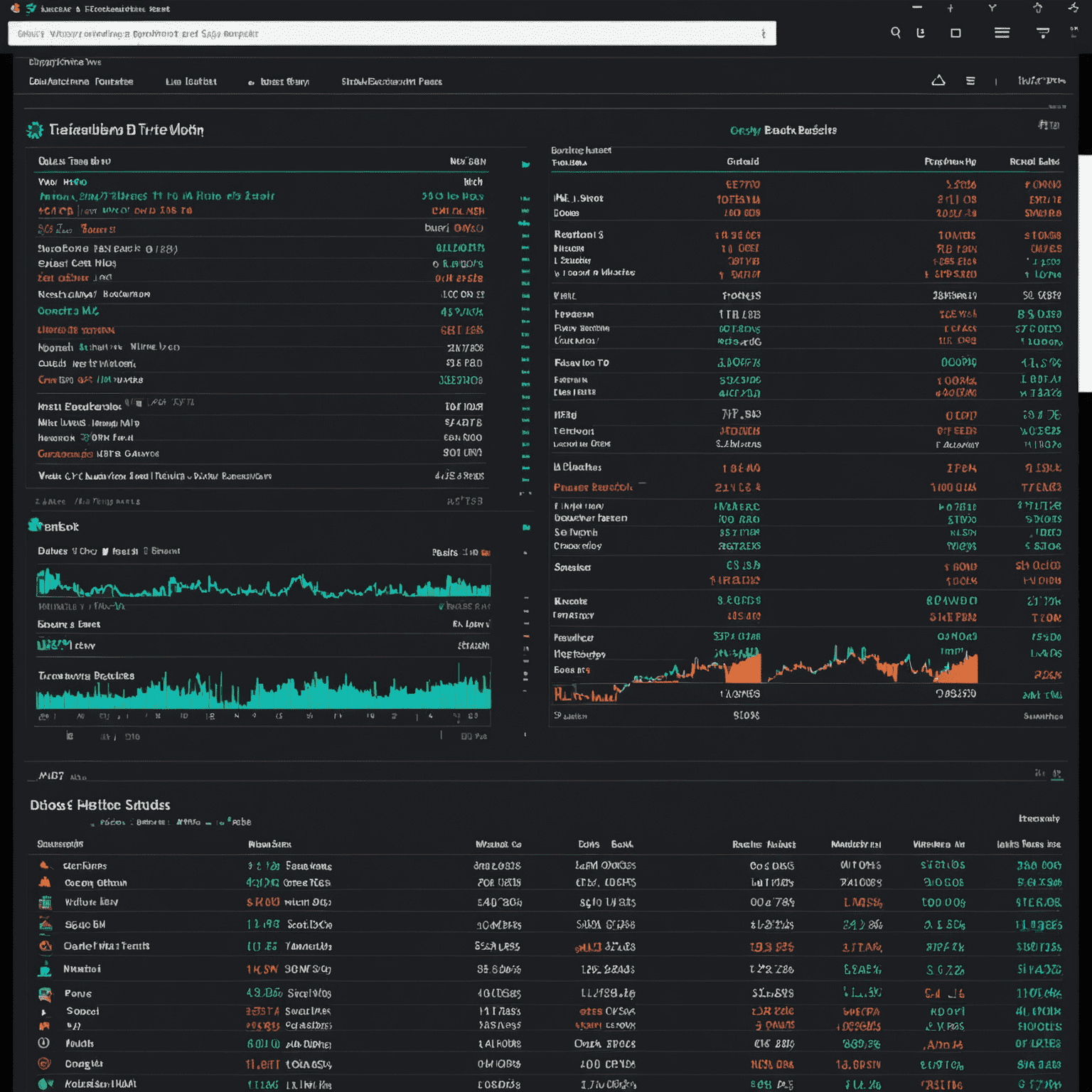

Backtesting Your Strategy

TradingView's platform allows you to backtest your strategy across different timeframes and instruments. Pay attention to:

- Overall performance metrics

- Drawdown periods

- Win rate and expertfit factor

- Behavior in different market conditions

Optimizing Your Strategy

Use TradingView's strategy tester to optimize your parameters:

- Identify key parameters (e.g., moving average length)

- Set a range for each parameter

- Run the optimization to find the optimal combination

- Be cautious of overfitting - test on out-of-sample data

Common Pitfalls to Avoid

- Overfitting: Don't optimize too much on historical data

- Ignoring transaction costs: Include realistic fees in your backtest

- Neglecting risk management: Always include stop-loss and position sizing

- Curve fitting: Ensure your strategy works across multiple symbols and timeframes

Conclusion

Creating and backtesting trading strategies with TradingView's Pine Script is a powerful way to develop and refine your trading ideas. Remember that past performance doesn't guarantee future results, and always practice appropriateper risk management when trading live.